Find Alternative Methods for Financing Remodeling Projects & Close More Design Deals

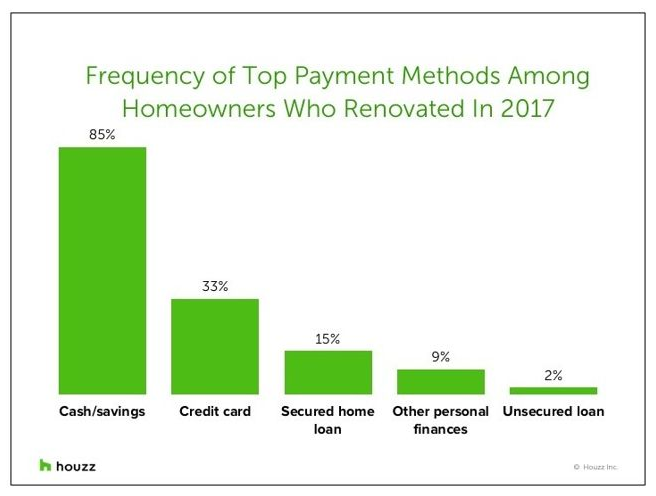

As outlined in a previous post, titled Interior Design Tips: Dealing with Client Fear, most design clients list the potential cost of a remodel as their number one fear. As we stated then, what they truly fear is taking a risk or making a blunder, often preventing them from moving forward. And, while this remains true, cost remains an impediment to closing the deal on a remodeling project. Knowing this, a sharp designer will find alternative methods for financing remodeling projects – and, by doing so, will close more deals.In the cost-related post, we offered this advice: Being realistic and honest with your clients is the key to overcoming the fear of cost. Whether the project stays within budget will depend on how thoroughly you’ve thought it through for them. If you have done your research on what things cost, requested quotes from contractors, and truly nailed the scope of the project, you can expect to be within a realistic range that your client can accept.We also offered this potential solution: Plan the project thoroughly, know your parameters and limitations and do your research so that you have a realistic budget to work within.Here, we would like to present you with another solution that may help you overcome the cost objection to your interior design projects:How to Pay for a Home Remodeling ProjectAccording to an article at Houzz.com, the majority of home remodeling projects are paid out-of-hand, with clients using cash or savings. Naturally, the fear of depleting their cash reserves can add to a potential client’s fear of the price you quote them to complete a project. For the savvy interior designer, however, presenting alternative methods for financing a remodeling project will help allay this fear – and may be the key to closing the deal with a client who is on the fence.It may surprise you to know that some 85% of 2017 home remodeling projects were paid for with cash (according to the Houzz survey). However, it may be just as surprising to learn that just 54% of those projects were paid for using only cash as the client’s sole method of payment. This information opens to door to you helping your clients find alternative methods for financing remodeling projects.Below is a graph which outlines the ways in which most design clients pay for home remodeling projects, along with alternatives for financing them.

As outlined in a previous post, titled Interior Design Tips: Dealing with Client Fear, most design clients list the potential cost of a remodel as their number one fear. As we stated then, what they truly fear is taking a risk or making a blunder, often preventing them from moving forward. And, while this remains true, cost remains an impediment to closing the deal on a remodeling project. Knowing this, a sharp designer will find alternative methods for financing remodeling projects – and, by doing so, will close more deals.In the cost-related post, we offered this advice: Being realistic and honest with your clients is the key to overcoming the fear of cost. Whether the project stays within budget will depend on how thoroughly you’ve thought it through for them. If you have done your research on what things cost, requested quotes from contractors, and truly nailed the scope of the project, you can expect to be within a realistic range that your client can accept.We also offered this potential solution: Plan the project thoroughly, know your parameters and limitations and do your research so that you have a realistic budget to work within.Here, we would like to present you with another solution that may help you overcome the cost objection to your interior design projects:How to Pay for a Home Remodeling ProjectAccording to an article at Houzz.com, the majority of home remodeling projects are paid out-of-hand, with clients using cash or savings. Naturally, the fear of depleting their cash reserves can add to a potential client’s fear of the price you quote them to complete a project. For the savvy interior designer, however, presenting alternative methods for financing a remodeling project will help allay this fear – and may be the key to closing the deal with a client who is on the fence.It may surprise you to know that some 85% of 2017 home remodeling projects were paid for with cash (according to the Houzz survey). However, it may be just as surprising to learn that just 54% of those projects were paid for using only cash as the client’s sole method of payment. This information opens to door to you helping your clients find alternative methods for financing remodeling projects.Below is a graph which outlines the ways in which most design clients pay for home remodeling projects, along with alternatives for financing them. Alternative Methods for Financing Remodeling Projects

Alternative Methods for Financing Remodeling Projects

- Credit cards – The options here are store-specific cards and credit cards not tied to a specific store. The upside of this method is that your client could earn rewards points, but the downside is potentially paying interest. According to the survey, 33% of homeowners used credit cards to pay for home renovations in 2017, though most were combined with the use of cash.

- Secured loans – With secured financing, your client pledges collateral; an asset that would serve as a default payment in the event they fail to pay off the loan. There are several types that can be used to pay for a home remodel. Again, each of them would come with interest on the principal portion of the loan.

- Home equity lines of credit – Also known as HELOCs, these are revolving lines of credit that can be taken out against home equity. Essentially, the client borrows against the equity in their home, and the house is used as collateral for the debt. As the loan is repaid, the line of credit is replenished, meaning they can borrow against again, it in the future. Some 7% of homeowners surveyed who renovated in 2017 used HELOCs to pay for their projects.

- Cash-out refinancing – This is a home mortgage refinance in which the new mortgage is for a larger amount than the existing mortgage, with the difference converted to cash for the homeowner. Some 5% of homeowners surveyed, who renovated in 2017, used cash-out refinancing to pay for their renovations.

- Home equity loans – A home equity loan is a type of second mortgage that allows your client to borrow against the value of their home. It may be a general loan, a construction loan or a home improvement loan. About 4% percent of homeowners used home equity loans to pay for their renovations last year. (Additionally, since this is a home loan, any interest paid may be tax deductible.)

- Unsecured loans – These are loans that don’t require collateral. Qualifying for such a loan is based on your client’s credit score and income and, of course, there is interest that must be paid over the life of the loan. Just 2% of homeowners Houzz surveyed paid for 2017 home renovations with unsecured loans.

Since a home remodeling project will often require a significant investment by the homeowner, a clever interior designer will often present prospects with alternative methods for financing remodeling projects. Where possible, the designer may even build a relationship with a local bank or credit union to offer such financing. By researching and offering this information to your prospects and clients, you will surely close more remodeling deals.Looking for more interior designer marketing tips, new design trends, and design product ideas? Get in touch with TD Fall today.